Recently, the General Financial Rules for the Retirement Savings Systems (Disposiciones de carácter general en materia financiera de los Sistemas de Ahorro para el Retiro, “Financial Rules for Retirement Funds”) were amended in order to include special requirements for the investment of Retirement Funds in certificates of capital development (Certificados de Capital de Desarrollo, “CKDs”) and investment projects certificates (Certificados Bursátiles Fiduciarios de Proyectos de Inversión, “CERPIs”).

CKDs and CERPIs are financial instruments regulated by the Securities Market Law (Ley del Mercado de Valores) and the General Provisions Applicable to Issuers of Securities and other Market Participants (Disposiciones de Carácter General aplicables a las Emisoras de Valores y a otros Participantes del Mercado de Valores).

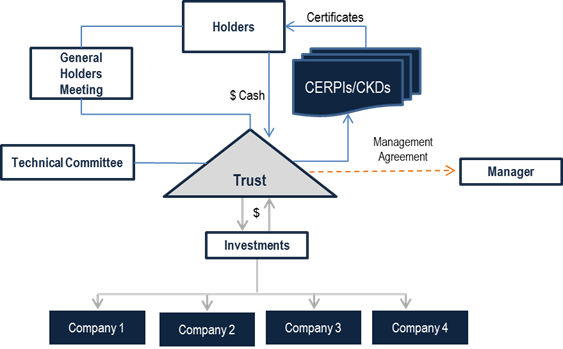

The basic structure of a trust issuing CKDs or CERPIs is as follows:

Institutional investors, such as retirement funds, are the main investors in CKDs and CERPIs issuances. Retirement funds’ investment regime is mainly provided for in the Investment Regulations for Retirement Funds (Disposiciones de Carácter General que Establecen el Régimen de Inversión al que Deberán Sujetarse las Sociedades de Inversión Especializadas de Fondos para el Retiro) and in the Financial Rules for Retirement Funds.

The following are the relevant points related to CKDs and CERPIs in the recent amendment to the Financial Rules for Retirement Funds:

1.- The investment committees of retirement funds managers should set forth policies aligning interests between the manager of the trust issuing the securities and the investors.

2.- Such policies shall include the co-investment percentage applicable to the manager of the trust. The percentage will be determined assessing the risks of the projects to be financed.

3.- For CERPIs:

3.1. The structure of the issuance shall include an additional investment vehicle or co-investor that is to invest in the same projects in which the issuing trust invests;

3.2. The co-investment of the additional vehicle or co-investor shall represent no less than 30% of the value of the financed projects. The co-investor’s investment may be carried out through the acquisition of the CERPIs issued by the trust.

3.3. The proceeds from the offering shall be aimed at financing projects in México.

3.4. The manager of the trust shall participate with at least 2% of the value of the investments carried out by the issuance trust. If the manager of the trust participates as co-investor, then said 2% will not be additional to the required co-investment amount.

The most recent amendments to the Financial Rules for Retirement Funds set forth important differences between CERPIs and CKDs that should be taken into consideration when structuring either of such vehicles.

Although the projects that are to be financed through the issuance of CERPIs and CKDs shall be located in Mexico, there is no restriction to the nationality of investors and co-investors. The co-investment requirement applicable to the issuance of CERPIs may represent an interesting opportunity for foreign investment funds that are looking for long-term investment opportunities.

Rebeca Sanchez Perez has extensive experience practicing corporate and finance law. She advises Mexico and international clients on a variety of matters, including foreign investment, corporate restructuring, minority rights, mergers, acquisitions and joint ventures, data protection, and public and private financing, such as the incorporation of private equity funds.